Firm Resources and Sustained Competitive Advantage

This work is pivotal for the emergence of the resource-based view of the firm, the dominant framework for analyzing competitive strategy. Previous work in this space has assumed homogeneity of the firms to emphasize the effects of competitive environment. This works breaks down these assumptions and highlights the heterogeneity and immobility of firm attributes and resources. In fact, no firm can have sustained competitive advantage if the firm resources are uniform and/or can be bought in a market. For a firm resource to hold the potential for sustained competitive advantage, it has to be (a) valuable, (b) rare, (c) imperfectly imitable and (d) not substitutable by an equivalent resource. Imperfect imitability of a resource can arise because it is (i) history dependent, (ii) causally ambiguous or (iii) socially complex.

Yellow highlights/annotations are my own. You can disable them.Abstract

Understanding sources of sustained competitive advantage has become a major area of research in strategic management. Building on the assumptions that strategic resources are heterogeneously distributed across firms and that these differences are stable over time, this article examines the link between firm resources and sustained competitive advantage. Four empirical indicators of the potential of firm resources to generate sustained competitive advantage—value, rareness, imitability, and substitutability—are discussed. The model is applied by analyzing the potential of several firm resources for generating sustained competitive advantages. The article concludes by examining implications of this firm resource model of sustained competitive advantage for other business disciplines.

Introduction

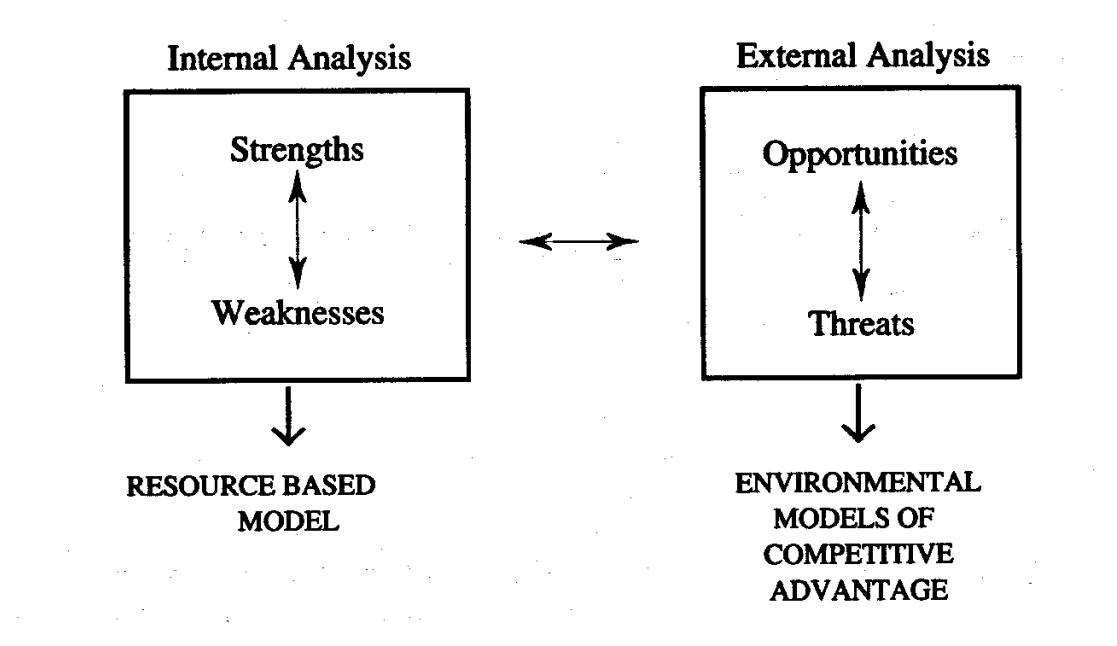

Understanding sources of sustained competitive advantage for firms has become a major area of research in the field of strategic management (Porter, 1985; Rumelt, 1984). Since the 1960s, a single organizing framework has been used to structure much of this research (Andrews, 1971; Ansoff, 1965; Hofer & Schendel, 1978). This framework, summarized in Figure One, suggests that firms obtain sustained competitive advantages by implementing strategies that exploit their internal strengths, through responding to environmental opportunities, while neutralizing external threats and avoiding internal weaknesses. Most research on sources of sustained competitive advantage has focused either on isolating a firm’s opportunities and threats (Porter, 1980, 1985), describing its strengths and weaknesses (Hofer & Schendel, 1978; Penrose, 1958; Stinchcombe, 1965), or analyzing how these are matched to choose strategies.

Figure One. The relationship between traditional “strengths-weaknesses-opportunities-threats” analysis, the resource based model, and models of industry attractiveness.

Although both internal analyses of organizational strengths and weaknesses and external analyses of opportunities and threats have received some attention in the literature, recent work has tended to focus primarily on analyzing a firm’s opportunities and threats in its competitive environment (Lamb, 1984). As exemplified by research by Porter and his colleagues (Caves & Porter, 1977; Porter, 1980, 1985) this work has attempted to describe the environmental conditions that favor high levels of firm performance. Porter’s (1980) “five forces model,” for example, describes the attributes of an attractive industry and thus suggests that opportunities will be greater, and threats less, in these kinds of industries.

To help focus the analysis of the impact of a firm’s environment on its competitive position, much of this type of strategic research has placed little emphasis on the impact of idiosyncratic firm attributes on a firm’s competitive position (Porter, 1990). Implicitly, this work has adopted two simplifying assumptions. First, these environmental models of competitive advantage have assumed that firms within an industry (or firms within a strategic group) are identical in terms of the strategically relevant resources they control and the strategies they pursue (Porter, 1981; Rumelt, 1984; Scherer, 1980). Second, these models assume that should resource heterogeneity develop in an industry or group (perhaps through new entry), that this heterogeneity will be very short lived because the resources that firms use to implement their strategies are highly mobile (i.e., they can be bought and sold in factor markets) (Barney, 1986a; Hirshleifer, 1980). Thus, for example, Porter (1980) suggests that firms should analyze their competitive environment, choose their strategies, and then acquire the resources needed to implement their strategies. Firms are assumed to have the same resources to implement these strategies or to have the same access to these resources. More recently, Porter (1985) has introduced a language for discussing possible internal organizational attributes that may affect competitive advantage. The relationship between this “value chain” logic and the resource based view of the firm is examined below.

There is little doubt that these two assumptions have been very fruitful in clarifying our understanding of the impact of a firm’s environment on performance. However, the resource-based view of competitive advantage, because it examines the link between a firm’s internal characteristics and performance, obviously cannot build on these same assumptions. These assumptions effectively eliminate firm resource heterogeneity and immobility as possible sources of competitive advantage (Penrose, 1958; Rumelt, 1984; Wernerfelt, 1984, 1989). The resource-based view of the firm substitutes two alternate assumptions in analyzing sources of competitive advantage. First, this model assumes that firms within an industry (or group) may be heterogeneous with respect to the strategic resources they control. Second, this model assumes that these resources may not be perfectly mobile across firms, and thus heterogeneity can be long lasting. The resource-based model of the firm examines the implications of these two assumptions for the analysis of sources of sustained competitive advantage.

This article begins by defining some key terms, and then examining the role of idiosyncratic, immobile firm resources in creating sustained competitive advantages. Next, a framework for evaluating whether or not particular firm resources can be sources of sustained competitive advantage is developed. As an example of how this framework might be applied, it is used in the analysis of the competitive implications of several resources that others have suggested might be sources of sustained competitive advantage. The article concludes by describing the relationship between this resource-based model of sustained competitive advantage and other business disciplines.

Defining Key Concepts

To avoid possible confusion, three concepts that are central to the perspective developed in this article are defined in this section. These concepts are firm resources, competitive advantage, and sustained competitive advantage.

Firm Resources

In this article, firm resources include all assets, capabilities, organizational processes, firm attributes, information, knowledge, etc. controlled by a firm that enable the firm to conceive of and implement strategies that improve its efficiency and effectiveness (Daft, 1983). In the language of traditional strategic analysis, firm resources are strengths that firms can use to conceive of and implement their strategies (Learned, Christensen, Andrews, & Guth, 1969; Porter, 1981).

A variety of authors have generated lists of firm attributes that may enable firms to conceive of and implement value-creating strategies (Hitt & Ireland, 1986; Thompson & Strickland, /1987). For purposes of this discussion, these numerous possible firm resources can be conveniently classified into three categories: physical capital resources (Williamson, I975), human capital resources (Becker, 1964), and organizational capital resources (Tomer, 1987). Physical capital resources include the physical technology used in a firm, a firm’s plant and equipment, its geographic location, and its access to raw materials. Human capital resources include the training, experience, judgment, intelligence, relationships, and insight of individual managers and workers in a firm. Organizational capital resources include a firm’s formal reporting structure, its formal and informal planning, controlling, and coordinating systems, as well as informal relations among groups within a firm and between a firm and those in its environment.

Of course, not all aspects of a firm’s physical capital, human capital, and organizational capital are strategically relevant resources. Some of these firm attributes may prevent a firm from conceiving of and implementing valuable strategies (Barney, 1986b). Others may lead a firm to conceive of and implement strategies that reduce its effectiveness and efficiency. Still others may have no impact on a firm’s strategizing processes. However, those attributes of a firm’s physical, human, and organizational capital that do enable a firm to conceive of and implement strategies that improve its efficiency and effectiveness are, for purposes of this discussion, firm resources (Wernerfelt, 1984). The purpose of this article is to specify the conditions under which such firm resources can be a source of sustained competitive advantage for a firm.

Competitive Advantage and Sustained Competitive Advantage

In this article, a firm is said to have a competitive advantage when it is implementing a value creating strategy not simultaneously being implemented by any current or potential competitors. A firm is said to have a sustained competitive advantage when it is implementing a value creating strategy not simultaneously being implemented by any current or potential competitors and when these other firms are unable to duplicate the benefits of this strategy. These two definitions require some discussion.

First, these definitions do not focus exlusively on a firm’s competitive position vis-a-vis firms that are already operating in its industry. Rather, following Baumol, Panzar, and Willig (1982), a firm’s competition is assumed to include not only all of its current competitors, but also potential competitors poised to enter an industry at some future date. Thus, a firm that enjoys a competitive advantage or a sustained competitive advantage is implementing a strategy not simultaneously being implemented by any of its current or potential competitors (Barney, McWilliams, & Turk, 1989).

Second, the definition of sustained competitive advantage adopted here does not depend upon the period of calendar time during which a firm enjoys a competitive advantage. Some authors have suggested that a sustained competitive advantage is simply a competitive advantage that lasts a long period of calendar time (Jacobsen, 1988; Porter, 1985). Although an understanding of how firms can make a competitive advantage last a longer period of calendar time is an important research issue, the concept of sustained competitive advantage used in this article does not refer to the period of calendar time that a firm enjoys a competitive advantage.

Rather, whether or not a competitive advantage is sustained depends upon the possibility of competitive duplication. Following Lippman and Rumelt (1982) and Rumelt (1984), a competitive advantage is sustained only if it continues to exist after efforts to duplicate that advantage have ceased. In this sense, this definition of sustained competitive advantage is an equilibrium definition (Hirshleifer, 1982).

Theoretically, this equilibrium definition of sustained competitive advantage has several advantages, not the least of which is that it avoids the difficult problem of specifying how much calendar time firms in different industries must possess competitive advantages in order for those advantages to be “sustained.” Empirically, sustained competitive advantages may, on average, last a long period of calendar time. However, it is not this period of calendar time that defines the existence of a sustained competitive advantage, but the inability of current and potential competitors to duplicate that strategy that makes a competitive advantage sustained.

Finally, that a competitive advantage is sustained does not imply that it will “last forever.” It only suggests that it will not be competed away through the duplication efforts of other firms. Unanticipated changes in the economic structure of an industry may make what was, at one time, a source of sustained competitive advantage, no longer valuable for a firm, and thus not a source of any competitive advantage. These structural revolutions in an industry—called “Schumpeterian Shocks” by several authors (Barney, 1986c; Rumelt & Wensley, 1981; Schumpeter, 1934, 1950)–redefine which of a firm’s attributes are resources and which are not. Some of these resources, in turn, may be sources of sustained competitive advantage in the newly defined industry structure (Barney, 1986c). However, what were resources in a previous industry setting may be weaknesses, or simply irrelevant, in a new industry setting. A firm enjoying a sustained competitive advantage may experience these major shifts in the structure of competition, and may see its competitive advantages nullified by such changes. However, a sustained competitive advantage is not nullified through competing firms duplicating the benefits of that competitive advantage.

Competition with Homogeneous and Perfectly Mobile Resources

Armed with these definitions, it is now possible to explore the impact of resource heterogeneity and immobility on sustained competitive advantage. This is done by examining the nature of competition when firm resources are perfectly homogeneous and mobile.

In this analysis, it is not being suggested that there are industries where the attributes of perfect homogeneity and mobility exist. Although this is ultimately an empirical question, it seems reasonable to expect that most industries will be characterized by at least some degree of resource heterogeneity and immobility (Barney & Hoskisson, 1989). Thus, rather than making an assertion that firm resources are homogeneous and mobile, the purpose of this analysis is to examine the possibility of discovering sources of sustained competitive advantage under these conditions. Not surprisingly, it is argued that firms, in general, cannot expect to obtain sustained competitive advantages when strategic resources are evenly distributed across all competing firms and highly mobile. This conclusion suggests that the search for sources of sustained competitive advantage must focus on firm resource heterogeneity and immobility.

Resource Homogeneity and Mobility and Sustained Competitive Advantage

Imagine an industry where firms possess exactly the same resources. This condition suggests that firms all have the same amount and kinds of strategically relevant physical, human, and organizational capital. Is there a strategy that could be conceived of and implemented by any one of these firms that could not also be conceived of and implemented by all other firms in this industry? The answer to this question must be no. The conception and implementation of strategies employs various firm resources (Barney, 1986a; Hatten & Hatten, 1987;Wernerfelt, 1984). That one firm in an industry populated by identical firms has the resources to conceive of and implement a strategy means that these other firms, because they possess the same resources, can also conceive of and implement this strategy. Because these firms all implement the same strategies, they all will improve their efficiency and effectiveness in the same way, and to the same extent. Thus, in this kind of industry, it is not possible for firms to enjoy a sustained competitive advantage.

Resource Homogeneity and Mobility and First-Mover Advantages

One objection to this conclusion concerns so-called “first mover advantages” (Lieberman & Montgomery, 1988). In some circumstances, the first firm in an industry to implement a strategy can obtain a sustained competitive advantage over other firms. These firms may gain access to distribution channels, develop goodwill with customers, or develop a positive reputation, all before firms that implement their strategies later. Thus, first-moving firms may obtain a sustained competitive advantage.

However, upon reflection, it seems clear that if competing firms are identical in the resources they control, it is not possible for any one firm to obtain a competitive advantage from first moving. To be a first mover by implementing a strategy before any competing firms, a particular firm must have insights about the opportunities associated with implementing a strategy that are not possessed by other firms in the industry, or by potentially entering firms (Lieberman & Montgomery, 1988). This unique firm resource (information about an opportunity) makes it possible for the better informed firm to implement its strategy before others. However, by definition, there are no unique firm resources in this kind of industry. If one firm in this type of industry is able to conceive of and implement a strategy, then all other firms will also be able to conceive of and implement that strategy, and these strategies will be conceived of and implemented in parallel, as identical firms become aware of the same opportunities and exploit that opportunity in the same way.

It is not being suggested that there can never be first-mover advantages in industries. It is being suggested that in order for there to be a first-mover advantage, firms in an industry must be heterogeneous in terms of the resources they control.

Resource Homogeneity and Mobility and Entry/Mobility Barriers

A second objection to the conclusion that sustained competitive advantages cannot exist when firm resources in an industry are perfectly homogeneous and mobile concerns the existence of “barriers to entry” (Bain, 1956), or more generally, “mobility barriers” (Caves & Porter, 1977). The argument here is that even if firms within an industry (group) are perfectly homogeneous, if there are strong entry or mobility barriers, these firms may be able to obtain a sustained competitive advantage vis-a-vis firms that are not in their industry (group). This sustained competitive advantage will be reflected in above normal economic performance for those firms protected by the entry or mobility barrier (Porter, 1980).

However, from another point of view, barriers to entry or mobility are only possible if current and potentially competing firms are heterogeneous in terms of the resources they control and if these resources are not perfectly mobile (Barney, McWilliams, Turk, 1989). The heterogeneity requirement is self-evident. For a barrier to entry or mobility to exist, firms protected by these barriers must be implementing different strategies than firms seeking to enter these protected areas of competition. Firms restricted from entry are unable to implement the same strategies as firms within the industry or group. Because the implementation of strategy requires the application of firm resources, the inability of firms seeking to enter an industry or group to implement the same strategies as firms within that industry or group suggests that firms seeking to enter must not have the same strategically relevant resources as firms within the industry or group. Thus, barriers to entry and mobility only exist when competing firms are heterogeneous in terms of the strategically relevant resources they control. Indeed, this is the definition of strategic groups suggested by McGee and Thomas (1986).

The requirement that firm resources be immobile in order for barriers to entry or mobility to exist is also clear. If firm resources are perfectly mobile, then any resource that allows some firms to implement a strategy protected by entry or mobility barriers can easily be acquired by firms seeking to enter into this industry or group. Once these resources are acquired, the strategy in question can be conceived of and implemented in the same way that other firms have conceived of and implemented their strategies. These strategies are thus not a source of sustained competitive advantage.

Again, it is not being suggested that entry or mobility barriers do not exist. However, it is being suggested that these barriers only become sources of sustained competitive advantage when firm resources are not homogeneously distributed across competing firms and when these resources are not perfectly mobile.

Research that has focused on the impact of opportunities and threats in a firm’s environment on competitive advantage has recognized the limitations inherent in analyzing competitive advantage with the assumption that firm resources are homogeneously distributed and highly mobile. In his recent work, Porter (1985) introduced the concept of the value chain to assist managers in isolating potential resource-based advantages for their firms. The resource-based view of the firm developed here simply pushes this value chain logic further, by examining the attributes that resources isolated by value chain analyses must possess in order to be sources of sustained competitive advantage (Porter, 1990).

Firm Resources and Sustained Competitive Advantage

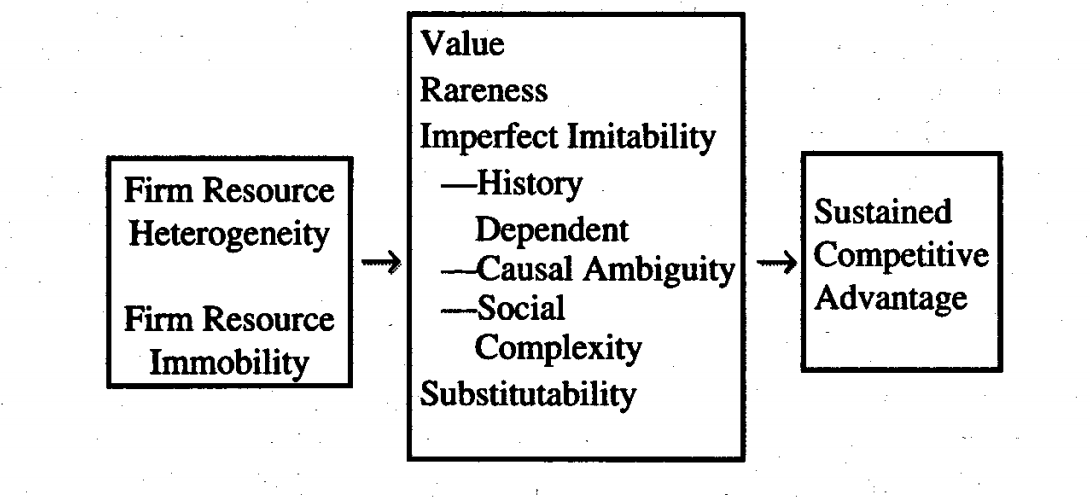

Thus far, it has been suggested that in order to understand sources of sustained competitive advantage, it is necessary to build a theoretical model that begins with the assumption that firm resources may be heterogeneous and immobile. Of course, not all firm resources hold the potential of sustained competitive advantages. To have this potential, a firm resource must have four attributes: (a) it must be valuable, in the sense that it exploit opportunities and/or neutralizes threats in a firm’s environment, (b) it must be rare among a firm’s current and potential competition, (c) it must be imperfectly imitable, and (d) there cannot be strategically equivalent substitutes for this resource that are valuable but neither rare or imperfectly imitable. These attributes of firm resources can be thought of as empirical indicators of how heterogeneous and immobile a firm’s resources are and thus how useful these resources are for generating sustained competitive advantages. Each of these attributes of a firm’s resources are discussed in more detail below.

Valuable Resources

Firm resources can only be a source of competitive advantage or sustained competitive advantage when they are valuable. As suggested earlier, resources are valuable when they enable a firm to conceive of or implement strategies that improve its efficiency and effectiveness. The traditional “strengths-weaknesses-opportunities-threats” model of firm performance suggests that firms are able to improve their performance only when their strategies exploit opportunities or neutralize threats. Firm attributes may have the other characteristics that could qualify them as sources of competitive advantage (e.g., rareness, inimitability, non-substitutability), but these attributes only become resources when they exploit opportunities or neutralize threats in a firm’s environment.

That firm attributes must be valuable in order to be considered resources (and thus as possible sources of sustained competitive advantage) points to an important complementarity between environmental models of competitive advantage and the resource-based model. These environmental models help isolate those firm attributes that exploit opportunities and/or neutralize threats, and thus specify which firm attributes can be considered as resources. The resource-based model then suggests what additional characteristics that these resources must possess if they are to generate sustained competitive advantage.

Rare Resources

By definition, valuable firm resources possessed by large numbers of competing or potentially competing firms cannot be sources of either a competitive advantage or a sustained competitive advantage. A firm enjoys a competitive advantage when it is implementing a value-creating strategy not simultaneously implemented by large numbers of other firms. If a particular valuable firm resource is possessed by large numbers of firms, then each of these firms have the capability of exploiting that resource in the same way, thereby implementing a common strategy that gives no one firm a competitive advantage.

The same analysis applies to bundles of valuable firm resources used to conceive of and implement strategies. Some strategies require a particular mix of physical capital, human capital, and organizational capital resources to implement. One firm resource required in the implementation of almost all strategies is managerial talent (Hambrick, 1987). If this particular bundle of firm resources is not rare, then large numbers of firms will be able to conceive of and implement the strategies in question, and these strategies will not be a source of competitive advantage, even though the resources in question may be valuable.

To observe that competitive advantages (sustained or otherwise) only accrue to firms that have valuable and rare resources is not to dismiss common (i.e., not rare) firm resources as unimportant. Instead, these valuable but common firm resources can help ensure a firm’s survival when they are exploited to create competitive parity in an industry (Barney, 1989a). Under conditions of competitive parity, though no one firm obtains a competitive advantage, firms do increase their probability of economic survival (McKelvey, 1980; Porter, 1980).

How rare a valuable firm resource must be in order to have the potential for generating a competitive advantage is a difficult question. It is not difficult to see that if a firm’s valuable resources are absolutely unique among a set of competing and potentially competing firms, those resources will generate at least a competitive advantage and may have the potential of generating a sustained competitive advantage. However, it may be possible for a small number of firms in an industry to possess a particular valuable resource and still generate a competitive advantage. In general, as long as the number of firms that possess a particular valuable resource (or a bundle of valuable resources) is less than the number of firms needed to generate perfect competition dynamics in an industry (Hirshleifer, 1980), that resource has the potential of generating a competitive advantage.

Imperfectly Imitable Resources

It is not difficult to see that valuable and rare organizational resources may be a source of competitive advantage. Indeed, firms with such resources will often be strategic innovators, for they will be able to conceive of and engage in strategies that other firms could either not conceive of, or not implement, or both, because these other firms lacked the relevant firm resources. The observation that valuable and rare organizational resources can be a source of competitive advantage is another way of describing first-mover advantages accruing to firms with resource advantages.

However, valuable and rare organizational resources can only be sources of sustained competitive advantage if firms that do not possess these resources cannot obtain them. In language developed in Lippman and Rumelt (1982) and Barney (1986a; 1986b), these firm resources are imperfectly imitable. Firm resources can be imperfectly imitable for one or a combination of three reasons: (a) the ability of a firm to obtain a resource is dependent upon unique historical conditions, (b) the link between the resources possessed by a firm and a firm’s sustained competitive advantage is causally ambiguous, or (c) the resource generating a firm’s advantage is socially complex (Dierickx & Cool, 1989). Each of these sources of the imperfect imitability of firm resources are examined below.

Unique historical conditions and imperfectly imitable resources. Another assumption of most environmental models of firm competitive advantage, besides resource homogeneity and mobility, is that the performance of firms can be understood independent of the particular history and other idiosyncratic attributes of firms (Porter, 1981; Scherer, 1980). These researchers seldom argue that firms do not vary in terms of their unique histories, but rather that these unique histories are not relevant to understanding a firm’s performance (Porter, 1980).

The resource-based view of competitive advantage developed here relaxes this assumption. Indeed, this approach asserts that not only are firms intrinsically historical and social entities, but that their ability to acquire and exploit some resources depends upon their place in time and space. Once this particular unique time in history passes, firms that do not have space- and time-dependent resources cannot obtain them, and thus these resources are imperfectly imitable.

Resource-based theorists are not alone in recognizing the importance of history as a determinant of firm performance and competitive advantage. Traditional strategy researchers (e.g., Ansoff, 1965; Learned et al., 1969; Stintchcombe, 1965) often cited the unique historical circumstances of a firm’s founding, or the unique circumstances under which a new management team takes over a firm, as important determinants of a firm’s long term performance. More recently, several economists (e.g., Arthur, Ermoliev, & Kaniovsky, 1987; David, 1985) have developed models of firm performance that rely heavily on unique historical events as determinants of subsequent actions. Employing path-dependent models of economic performance (Arthur, 1983, 1984a, 1984b; Arthur, Ermiliev, & Kaniovski, 1984) these authors suggest that the performance of a firm does not depend simply on the industry structure within which a firm finds itself at a particular point in time, but also on the path a firm followed through history to arrive where it is. If a firm obtains valuable and rare resources because of its unique path through history, it will be able to exploit those resources in implementing value-creating strategies that cannot be duplicated by other firms, for firms without that particular path through history cannot obtain the resources necessary to implement the strategy.

The acquisition of all the types of firm resources examined in this article can depend upon the unique historical position of a firm. A firm that locates it facilities on what turns out to be a much more valuable location than was anticipated when the location was chosen possesses an imperfectly imitable physical capital resource (Hirshleifer, 1988; Ricardo, 1966). A firm with scientists who are uniquely positioned to create or exploit a significant scientific breakthrough may obtain an imperfectly imitable resource from the history-dependent nature of these scientist’s individual human capital (Burgelman & Maidique, 1988; Winter, 1988). Finally, a firm with a unique and valuable organizational culture that emerged in the early stages of a firm’s history may have an imperfectly imitable advantage over firms founded in another historical period, where different (and perhaps less valuable) organizational values and beliefs come to dominate (Barney, 1986b; Zucker, 1977).

The literature in strategic management is littered with examples of firms whose unique historical position endowed them with resources that are not controlled by competing firms and that cannot be imitated. These examples are the case analyses that have dominated teaching and research for so long in the field of strategic management (Learned et al., 1969; Miles & Cameron,. 1982), However, the systematic study of the impact of history on firm performance is in its infancy (David, 1985).

Causal ambiguity and imperfectly imitable resources. Unlike the relationship between a firm’s unique history and the imitability of its resources, the relationship between the causal ambiguity of a firm’s resources and imperfect imitability has received systematic attention in the literature (Alchian, 1950; Barney, 1986b, Lippman & Rumelt, 1982; Mancke, 1974; Reed and DeFillippi, 1990; Rumelt, 1984). In this context, causal ambiguity exists when the link between the resources controlled by a firm and a firm’s sustained competitive advantage is not understood or understood only very imperfectly.

When the link between a firm’s resources and its sustained competitive advantage are poorly understood, it is difficult for firms that are attempting to duplicate a successful firm’s strategies through imitation of its resources to know which resources it should imitate. Imitating firms may be able to describe some of the resources controlled by a successful firm. However, under conditions of causal ambiguity, it is not clear that the resources that can be described are the same resources that generate a sustained competitive advantage, or whether that advantage reflects some other non-described firm resource. As Demsetz (1973) once observed, sometimes it is difficult to understand why one firm consistently outperforms other firms. Causal ambiguity is at the heart of this difficulty. In the face of such causal ambiguity, imitating firms cannot know the actions they should take in order to duplicate the strategies of firms with a sustained competitive advantage.

To be a source of sustained competitive advantage, both the firms that possess resources that generate a competitive advantage and the firms that do not possess these resources but seek to imitate them must be faced with the same level of causal ambiguity (Lippman & Rumelt, 1982). If firms that control these resources have a better understanding of their impact on competitive advantage than firms without these resources, then firms without these resources can engage in activities to reduce their knowledge disadvantage. They can do this, for example, by hiring away well placed knowledgeable managers in a firm with a competitive advantage or by engaging in a careful systematic study of the other firm’s success. Although acquiring this knowledge may take some time and effort, once knowledge of the link between a firm’s resources and its ability to implement certain strategies is diffused throughout competing firms, causal ambiguity no longer exists, and thus cannot be a source of imperfect imitability. In other words, if a firm with a competitive advantage understands the link between the resources it controls and its advantages, then other firms can also learn about that link, acquire the necessary resources (assuming they are not imperfectly imitable-for other reasons), and implement the relevant strategies. In such a setting, a firm’s competitive advantages are not sustained because they can be duplicated.

On the other hand, when a firm with a competitive advantage does not understand the source of its competitive advantage any better than firms without this advantage, that competitive advantage may be sustained because it is not subject to imitation (Lippman & Rumelt, 1982). Ironically, in order for causal ambiguity to be a source of sustained competitive advantage, all competing firms must have an imperfect understanding of the link between the resources controlled by a firm and a firm’s competitive advantages. If one competing firm understands this link, and no others do, in the long run this information will be diffused through all competitors, thus eliminating causal ambiguity and imperfect imitability based on causal ambiguity.

At first, it may seem unlikely that a firm with a sustained competitive advantage will not fully understand the source of that advantage. However, given the very complex relationship between firm resources and competitive advantage, such an incomplete understanding is not implausible. The resources controlled by a firm are very complex and interdependent. Often, they are implicit, taken for granted by managers, rather than being subject to explicit analysis (Nelson & Winter, 1982; Polanyi, 1962; Winter, 1988). Numerous resources, taken by themselves or in combination with other resources, may yield sustained competitive advantage. Although managers may have numerous hypotheses about which resources generate their firm’s advantages, it is rarely possible to rigorously test these hypotheses. As long as numerous plausible explanations of the sources of sustained competitive advantage exist within a firm, the link between the resources controlled by a firm and sustained competitive advantage remains somewhat ambiguous, and thus which of a firm’s resources to imitate remains uncertain.

Social complexity. A final reason that a firm’s resources may be imperfectly imitable is that they may be very complex social phenomena, beyond the ability of firms to systematically manage and influence. When competitive advantages are based in such complex social phenomena, the ability of other firms to imitate these resources is significantly constrained.

A wide variety of firm resources may be socially complex. Examples include the interpersonal relations among managers in a firm (Hambrick, 1987), a firm’s culture (Barney, 1986b), a firm’s reputation among suppliers (Porter, 1980) and customers (Klein, Crawford & Alchian, 1978; Klein & Lefler, 1981). Notice that in most of these cases it is possible to specify how these socially complex resources add value to a firm. Thus, there is little or no causal ambiguity surrounding the link between these firm resources and competitive advantage. However, understanding that, say, an organizational culture with certain attributes or quality relations among managers can improve a firm’s efficiency and effectiveness does not necessarily imply that firms without these attributes can engage in systematic efforts to create them (Barney, 1989b; Dierickx & Cool, 1989). Such social engineering may be, for the time being at least, beyond the capabilities of most firms (Barney, 1986b; Porras & Berg, 1978). To the extent that socially complex firm resources are not subject to such direct management, these resources are imperfectly imitable.

Notice that complex physical technology is not included in this category of sources of imperfectly imitable. In general, physical technology, whether it takes the form of machine tools or robots in factories (Hayes & Wheelwright, 1984) or complex information management systems (Howell & Fleishman, 1982), is by itself typically imitable. If one firm can purchase these physical tools of production and thereby implement some strategies, then other firms should also be able to purchase these physical tools, and thus such tools should not be a source of sustained competitive advantage.

On the other hand, the exploitation of physical technology in a firm often involves the use of socially complex firm resources. Several firms may all possess the same physical technology, but only one of these firms may possess the social relations, culture, traditions, etc. to fully exploit this technology in implementing strategies (Wilkins, 1989). If these complex social resources are not subject to imitation (and assuming they are valuable and rare and no substitutes exist), these firms may obtain a sustained competitive advantage from exploiting their physical technology more completely than other firms, even though competing firms do not vary in terms of the physical technology they possess.

Substitutability

The last requirement for a firm resource to be a source of sustained competitive advantage is that there must be no strategically equivalent valuable resources that are themselves either not rare or imitable. Two valuable firm resources (or two bundles of firm resources) are strategically equivalent when they each can be exploited separately to implement the same strategies. Suppose that one of these valuable firm resources is rare and imperfectly imitable, but the other is not. Firms with this first resource will be able to conceive of and implement certain strategies. If there were no strategically equivalent firm resources, these strategies would generate a sustained competitive advantage (because the resources used to conceive and implement them are valuable, rare, and imperfectly imitable). However, that there are strategically equivalent resources suggests that other current or potentially competing firms can implement the same strategies, but in a different way, using different resources. If these alternative resources are either not rare or imitable, then numerous firms will be able to conceive of and implement the strategies in question, and those strategies will not generate a sustained competitive advantage. This will be the case even though one approach to implementing these strategies exploits valuable, rare, and imperfectly imitable firm resources.

Substitutability can take at least two forms. First, though it may not be possible for a firm to imitate another firm’s resources exactly, it may be able to substitute a similar resource that enables it to conceive of and implement the same strategies. For example, a firm seeking to duplicate the competitive advantages of another firm by imitating that other firm’s high quality top management team will often be unable to copy that team exactly (Barney & Tyler, 1990). However, it may be possible for this firm to develop its own unique top management team. Though these two teams will be different (different people, different operating practices, a different history, etc.), they may likely be strategically equivalent and thus be substitutes for one another. If different top management teams are strategically equivalent (and if these substitute teams are common or highly imitable), then a high quality top management team is not a source of sustained competitive advantage, even though a particular management team of a particular firm is valuable, rare and imperfectly imitable.

Second, very different firm resources can also be strategic substitutes. For example, managers in one firm may have a very clear vision of the future of their company because of a charismatic leader in their firm (Zucker, 1977). Managers in competing firms may also have a very clear vision of the future of their companies, but this common vision may reflect these firms’ systematic, company-wide strategic planning process (Pearce, Freeman, & Robinson, 1987). From the point of view of managers having a clear vision of the future of their company, the firm resource of a charismatic leader and the firm resource of a formal planning system may be strategically equivalent, and thus substitutes for one another. If large numbers of competing firms have a formal planning system that generates this common vision (or if such a formal planning is highly imitable), then firms with such a vision derived from a charismatic leader will not have a sustained competitive advantage, even though the firm resource of a charismatic leader is probably rare and imperfectly imitable.

Of course, the strategic substitutability of firm resources is always a matter of degree. It is the case, however, that substitute firm resources need not have exactly the same implications for an organization in order for those resources to be equivalent from the point of view of the strategies that firms can conceive of and implement. If enough firms have these valuable substitute resources (i.e. they are not rare), or if enough firms can acquire them (i.e. they are imitable), then none of these firms (including firms whose resources are being substituted for) can expect to obtain a sustained competitive advantage.

Applying the Framework

The relationship between resource heterogeneity and immobility; value, rareness, imitability, and substitutability; and sustained competitive advantage is summarized in Figure Two. This framework can be applied in analyzing the potential of a broad range of firm resources to be sources of sustained competitive advantage. These analyses not only specify the theoretical conditions under which sustained competitive advantage might exist, they also suggest specific empirical questions that need to be addressed before the relationship between a particular firm resource and sustained competitive advantage can be understood. Three brief examples of how this framework might be applied are presented below.

Figure Two. The Relationship Between Resource Heterogeneity and Immobility, Value, Rareness, Imperfect Imitability, and Substitutability, and Sustained Competitive Advantage.

Strategic Planning and Sustained Competitive Advantage

There is a large and growing literature on the ability of various strategic planning processes to generate competitive advantages for firms (Pearce, Freeman, & Robinson, 1987). Evaluating strategic planning as a firm resource may help resolve some of the conflicting results in this literature (Armstrong, 1982; Rhyne, 1986).

It seems reasonable to expect that formal strategic planning systems (Lorange, 1980) are unlikely by themselves to be a source of sustained competitive advantage. Even if these planning systems are valuable, in the sense that they enable firms to recognize opportunities and threats in their environment, there is empirical evidence that suggests that many firms engage in such formal planning exercises, and thus such planning mechanisms are not rare (Kudla, 1980; Steiner, 1979). Even if in a particular industry formal planning is rare, the formal planning process has been thoroughly described and documented in a wide variety of public sources (Steiner, 1979). Any firm interested in engaging in such formal planning can certainly learn how to do so, and thus formal planning seems likely to be highly imitable (Barney, 1989b). Thus, apart from substitutability considerations, formal strategic planning by itself is not likely to be a source of sustained competitive advantage.

This does not mean, however, that firms that engage in formal strategic planning will never obtain sustained competitive advantages. It may be that the formal planning system in a firm enables a firm to recognize and exploit other of its resources, and some of these resources might be sources of sustained competitive advantage. However, it is probably inappropriate to conclude that the sustained competitive advantages thus created reflect the formal planning process per se. Rather, the source of these advantages is almost certainly other resources controlled by a firm.

Of course, formal strategic planning is not the only way that firms choose their strategies. A variety of authors have described informal (Leontiades & Tezel, 1980), emergent (Mintzberg, 1978; Mintzberg & McHugh, 1985), and autonomous (Burgelman, 1983) processes by which firms choose their strategies. To the extent that these processes suggest valuable strategies for firms, they can be thought of as firm resources, and their potential for generating sustained competitive advantage can be evaluated by considering how rare, imperfectly imitable, and substitutable they are.

Those who study these informal strategy-making processes tend to agree about their rareness and imitability. Although the rareness of these informal strategymaking processes is an empirical question, current research suggests that at least some firms attempt to prevent these informal processes from unfolding (Burgelman, 1983), or ignore the strategic insights they generate (Burgelman & Maidique, 1988). In industries where most current and potential competitors either prevent or ignore these informal processes, firms that understand their potential value may possess a rare strategic resource. Moreover, because these processes are socially complex (Mintzberg & McHugh, 1985), they are also likely to be imperfectly imitable.

There is less agreement concerning possible substitutes for these informal strategy-making processes. On the one hand, some authors seem to suggest that formal planning mechanisms are strategic substitutes for informal, emergent, or autonomous processes (Pearce, Freeman, & Robinson, 1987). If this is true, because these formal processes are highly imitable, informal strategy making has a highly imitable substitute, and thus is not a source of sustained competitive advantage. On the other hand, others have argued that formal and informal strategy making are not substitutes for one another, that formal processes are effective in some settings and ineffective in others, that informal processes are effective where formal processes are not and are ineffective when formal processes are effective (Fredrickson, 1984; Fredrickson & Mitchell, 1984). If these processes are not substitutes for one another, and if the conditions of rareness and imperfect imitability hold, informal strategy-making processes may be a source of sustained competitive advantage. The question of the subtitutability of informal strategy making in firms needs to be resolved empirically before the impact of these firm resources on sustained competitive advantage can be fully understood.

Information Processing Systems and Sustained Competitive Advantage

There is also a growing literature that focuses on information processing systems and sustained competitive advantage (O’Brien, 1983). As with strategic planning, whether or not information processing systems are a source of sustained competitive advantage depends on the type of information processing system being analyzed. If seems very unlikely that computers (of any size, no matter how they are linked or networked) by themselves, can be a source of sustained competitive advantage (Hayes & Wheelwright, 1984). Machines, be they computers or other types of machines, are part of the physical technology of a firm, and usually can be purchased across markets (Barney, 1986a). Because the machines can be purchased, any strategy that exploits just the machines themselves is likely to be imitable and thus not a source of sustained competitive advantage.

On the other hand, an information processing system that is deeply embedded in a firm’s informal and formal management decision-making process may hold the potential of sustained competitive advantage. Research seems to suggest that relatively few firms have been able to create this close manager-computer interface, and thus this kind of information processing system may be rare (Christie, 1985; Rasmussen, 1986). It is also a socially complex system, and thus will probably be imperfectly imitable.

The question of possible substitutes for these complex machine-manager systems has not received as much attention in the literature. To specify possible strategic substitutes requires understanding what strategic benefits accrue to a firm that possesses a system where computers and managers are intimately linked. Any list of possible benefits might include an efficient flow of information among managers, the ability of consider large amounts of information quickly, and the ability to share this information efficiently (O’Brien, 1983). These same benefits might accrue to a firm with a closely knit, highly experienced management team, without an information management system (Hambrick, 1987). Thus, this type of management team may be a substitute for an information-processing system embedded in a firm’s informal and formal decision-making processes.

However, the existence of substitutes by itself does not mean that a particular firm resource cannot be a source of sustained competitive advantage. In addition, these substitutes have to be either not rare, or highly imitable, or both. Closely knit, highly experienced management teams for a particular set of competitors may be rare and, because they are socially complex, may be imperfectly imitable. If this is true, an embedded information-processing system may be a source of sustained competitive advantage, even if a close substitute for such a processing system (a close knit, highly experienced top management team) exists.

Positive Reputations and Sustained Competitive Advantages

Positive reputations of firms among customers and suppliers have also been cited as sources of competitive advantage in the literature (Porter, 1980). An application of the framework presented in Figure Two, again, suggests the conditions under which a firm’s positive reputation can be a source of sustained competitive advantage. If only a few competing firms have such reputations, then they are rare. In general, the development of a positive reputation usually depends upon specific, difficult-to-duplicate historical settings. To the extent that a particular firm’s positive reputation depends upon such historical incidents, it may be imperfectly imitable. In addition, positive firm reputations can be thought of as informal social relations between firms and key stakeholders (Klein & Leffler, 1981). Such informal relations are likely to be socially complex, and thus imperfectly imitable.

The question of substitutes for a positive reputation is, again, more complicated. Some authors (Klein, Crawford, & Alchian, 1981) have suggested that rather than developing a positive reputation, firms may reassure their customers or suppliers through the use of guarantees and other long-term contracts. Thus, these guarantees substitute for a firm’s reputation. However, it is not clear that the implicit psychological contract between a firm and its stakeholders when a firm has a positive reputation is the same as the implicit psychological contract between a firm and its stakeholders when a firm uses guarantees for reassurance. If, in fact, reputation and guarantees are substitutes, why is it that some firms invest both in a positive reputation and guarantees? If these two firm resources are not substitutes, then a reputation (if it is rare and imperfectly imitable) may be a source of sustained competitive advantage.

Discussion

The brief analyses of strategic planning, information processing, and a firm’s reputation among customers and suppliers and sustained competitive advantage are suggestive of the kinds of analyses that are possible with the framework presented in Figure Two. This framework suggests the kinds of empirical questions that need to be addressed in order to understand whether or not a particular firm resource is a source of sustained competitive advantage: is that resource valuable, is it rare, is it imperfectly imitable, and are there substitutes for that resource? This resource-based model of sustained competitive advantage also has a variety of implications for the relationship between strategic management theory and other business disciplines. Some of these implications are considered below.

Sustained Competitive Advantage and Social Welfare

The model presented here addresses important social welfare issues linked with strategic management research. Most authors agree that the original purpose of the structure-conduct-performance paradigm in industrial organization economics was to isolate violations of the perfectly competitive model, to address these violations in order to restore the social welfare benefits of perfectly competitive industries (Barney, 1986c; Porter, 1981). As applied by strategy theorists focusing on environmental determinants of firm performance, social welfare concerns were abandoned in favor of the creation of imperfectly competitive industries within which a particular firm could gain a competitive advantage (Porter, 1980). At best, this approach to strategic analysis ignores social welfare concerns. At worst, this approach focuses on activities that firms can engage in that will almost certainly reduce social welfare (Hirshliefer, 1980),

The resource-based model developed here suggests that, in fact, strategic management research can be perfectly consistent with traditional social welfare concerns of economists. Beginning with the assumptions that firm resources are heterogeneous and immobile, it follows that a firm that exploits its resource advantages is simply behaving in an efficient and effective manner (Demsetz, 1973). To fail to exploit these resource advantages is inefficient and does not maximize social welfare. In this sense, the higher levels of performance that accrue to a firm with resource advantages are due to the efficiency of these firms in exploiting those advantages, rather than to the efforts of firms to create imperfectly competitive conditions in a way that fails to maximize social welfare. These profits, in a sense, can be thought of as “efficiency rents” (Demsetz, 1973) as opposed to “monopoly rents” (Scherer, 1980).

Sustained Competitive Advantage and Organization Theory and Behavior

Recently, a variety of authors have suggested that economic models of organizational phenomena fundamentally contradict models of organizations based in organization theory or organizational behavior (Donaldson, 1990a, 1990b; Perrow, 1986). This assertion is fundamentally contradicted by the resource-based model of sustained competitive advantage (Barney, 1990). This model suggests that sources of sustained competitive advantage are firm resources that are valuable, rare, imperfectly imitable, and non-substitutable. These resources include a broad range of organizational, social, and individual phenomena within firms that are the subject of a great deal of research in organization theory and organizational behavior (Daft, 1983). Rather than being contradictory, the resource-based model of strategic management suggests that organization theory and organizational behavior may be a rich source of findings and theories concerning rare, non-imitable, and non-substitutable resources in firms. Indeed, a resource-based model of sustained competitive advantage anticipates a more intimate integration of the organizational and the economic as a way to study sustained competitive advantage.

Firm Endowments and Sustained Competitive Advantage

Finally, the model presented here emphasizes the importance of what might be called firm resource endowments in creating sustained competitive advantages. Implicit in this model is the assumption that managers are limited in their ability to manipulate all the attributes and characteristics of their firms (Barney & Tyler, 1991). It is this limitation that makes some firm resources imperfectly imitable, and thus potentially sources of sustained competitive advantage. Thus, the study of sustained competitive advantage depends, in a critical way, on the resource endowments controlled by a firm.

That the study of sources of sustained competitive advantage focuses on valuable, rare, imperfectly imitable, and non-substitutable resource endowments does not suggest—as some population ecologists would have it (e.g., Hannan & Freeman, 1977)— that managers are irrelevant in the study of such advantages. In fact, managers are important in this model, for it is managers that are able to understand and describe the economic performance potential of a firm’s endowments. Without such managerial analyses, sustained competitive advantage is not likely. This is the case even though the skills needed to describe the rare, imperfectly imitable, and non-substitutable resources of a firm may themselves not be rare, imperfectly imitable, or non-substitutable.

Indeed, it may be the case that a manager or a managerial team is a firm resource that has the potential for generating sustained competitive advantages. The conditions under which this will be the case can be outlined using the framework presented in Figure Two. However, in the end, what becomes clear is that firms cannot expect to “purchase” sustained competitive advantages on open markets (Barney, 1986a, 1988; Wernerfelt, 1989). Rather, such advantages must be found in the rare, imperfectly imitable, and non-substitutable resources already controlled by a firm (Dierickx & Cool, 1989).

References

- Alchian, A.A. 1950. Uncertainty, evolution, and economic theory. American Economic Review, 58: 388-401.

- Andrews, K:R. 1971. The concept of corporate strategy. Homewood, IL: Dow Jones Irwin.

- Ansoff, H.I. 1965. Corporate strategy. New York: McGraw-Hill.

- Armstrong, J.S. 1982. The value of formal planning for strategic decisions: Review of empirical research. Strategic Management Journal, 3: 197-211.

- Arthur, W.B. 1983. Competing technologies and lock-in by historical small events: The dynamics of allocation under increasing returns. Unpublished manuscript, Center for Economic Policy Research, Stanford University.

- Arthur, W.B. 1984a. Industry location patterns and the importance of history: Why a silicon valley? Unpublished manuscript, Center for Economic Policy Research, Stanford University.

- Arthur, W.B. 1984b. Competing technologies and economic prediction. Options, IIASA, Laxenburg, Austria.

- Arthur, W.B., Ermoliev, Y., & Kaniovski, Y.M. 1984, Strong laws for a class of path dependent stochastic processes with applications. In Arkin, V.I., Shiryayev, A., and Wets, R. (Eds.), Proceedings of a Conference on Stochastic Optimization, Kiev 1984: 87-93.

- Arthur, W.B., Ermolieve, Y.M., & Kaniovsky, ¥.M. 1987. Path dependent processes and the emergence of marcro structure. European Journal of Operations Research, 30: 294-303.

- Bain, J. 1956. Barriers to new competition. Cambridge: Harvard University Press.

- Barney, LB. 1986a. Strategic factor markets: Expectations, luck, and business strategy. Management Science, 42: 1231-1241.

- Barney, JB. 1986b. Organizational culture: Can it be a source of sustained competitive advantage? Academy of Management Review, 11: 656-665.

- Barney, JB. 1986c. Types of competition and the theory of strategy: Toward an integrative framework. Academy of Management Review, 11: 791-800.

- Barney, JB. 1988. Returns to bidding firms in mergers and acquisitions: Reconsidering the relatedness hypothesis. Strategic Management Journal, 9: 71-78.

- Barney, JB. 1989. Asset stock accumulation and sustained competitive advantage: A comment. Management Science, 35: 1511-1513.

- Barney, JB. 1989b. The context of strategic planning and the economic performance of firms. Working paper no. 88-004, Strategy Group Working Paper Series, Department of Management, Texas A&M University.

- Barney, LB. 1990. The debate between traditional management theory and organizational economics: substantive differences or intergroup conflict? Academy of Management Review, 15: 382-393.

- Barney, JB., & Hoskisson, R. 1989. Strategic groups: Untested assertions and research proposals. Managerial and Decision Economics, 11: 187-198.

- Barney, JB., McWilliams, A., & Turk, T. 1989. On the relevance of the concept of entry barriers in the theory of competitive strategy. Paper presented at the annual meeting of the Strategic Management Society, San Francisco.

- Barney, JB., & Tyler, B. 1990. The attributes of top management teams and sustained competitive advantage. In M. Lawless & L. Gomez-Mejia (Eds.), Managing the High Technology Firm: JAI Press, in press.

- Barney, JB., & Tyler, B. 1991. The prescriptive limits and potential for applying strategic management theory, Managerial and Decision Economics, in press.

- Baumol, WJ, Panzar, LC., & Willig, R.P 1982. Contestable markets and the theory of industry structure. New York: Harcourt, Brace, and Jovanovich.

- Becker, G.S. 1964. Human capital. New York: Columbia.

- Burgelman R. 1983. Corporate entrepreneurship and strategic management: Insights from a process study. Management Science, 29: 1349-1364.

- Burgelman, R., & Maidique, M.A. 1988. Stategic management of technology and innovation. Homewood, IL: Irwin.

- Caves, R.E., & Porter, M. 1977. From entry barriers to mobility barriers: Conjectural decisions and contrived deterrence to new competition. Quarterly Journal of Economics, 91: 241-262.

- Christie, B. 1985. Human factors and information technology in the office. New York: Wiley.

- David, PA. 1985. Clio and the economics of QWERTY. American Economic Review Proceedings, 75: 332-337.

- Daft, R. 1983. Organization theory and design. New York: West.

- Dierickx, I, & Cool, K. 1989. Asset stock accumulation and sustainability of competitive advantage. Management Science, 35: 1504-1511.

- Fredrickson, J: 1984. The comprehensiveness of strategic decision processes: Extension, observations, future directions. Academy of Management Journal, 27: 445-466.

- Fredrickson, 1, & Mitchell, TR. 1984. Stategic decision processess: Comprehensiveness and performance in an industry with an unstable environment. Academy of Management Journal, 27: 399-423.

- Hambrick, D. 1987. Top management teams: Key to strategic success. California Management Review, 30: 88-108.

- Hatten; K.J, & Hatten, M.L. 1987. Stategic groups, asymmetrical mobility barriers and contestability. Strategic Management Journal, 8: 329-342.

- Hayes, R.H., & Wheelwright, S. 1984. Restoring our competitive edge. New York: Wiley.

- Hirshliefer, J. 1980. Price theory and applications (2nd ed.). Englewood Cliffs, NJ: Prentice-Hall.

- Hitt, M., & Ireland, D. 1986. Relationships among corporate level distinctive competencies, diversification strategy, corporate strategy and performance. Journal of Management Studies, 23: 401-416.

- Hofer, C., & Schendel, D. 1978. Strategy formulation: Analytical concepts. St. Paul, MN: West.

- Howell, W.C., & Fleishman, E.A. 1982. Information processing and decision making. Hillsdale, NJ: L. Erlbaum.

- Jacobsen, R. 1988. The persistence of abnormal returns. Strategic Management Journal, 9: 41-58.

- Klein, B., & Leffler, K. 1981. The role of price in guaranteeing quality. Journal of Political Economy, 89: 615-641.

- Klein, B., Crawford, R.G., & Alchian, A. 1978. Vertical integration, appropriable rents, and the competitive contracting process. Journal of Law and Economics, 21: 297-326.

- Kudla, R.J. 1980. The effects of strategic planning on common stock returns. Academy of Management Journal, 23: 5-20.

- Learned, E.P, Christensen, C.R., Andrews, K.R., & Guth, W. 1969. Business policy. Homewood, IL: Irwin.

- Leontiades, M., & Tezel, A. 1980. Planning perceptions and planning results. Strategic Management Journal, 1: 65-79.

- Lieberman, M.B., & Montgomery, D.B. 1988. First mover advantages. Stategic Management Journal, 9: 41-58.

- Lippman, S., & Rumelt, R. 1982. Uncertain imitability: An analysis of interfirm differences in efficiency under competition. Bell Journal of Economics, 13: 418-438.

- Lorange, P. 1980. Corporate planning: An executive viewpoint. Englewood Cliffs, NJ: Prentice-Hall.

- Mancke, R. 1974. Causes of interfirm profitability differences: A new interpretation of the evidence. Quarterly Journal of Economics, 88: 181-193.

- McGee, I, & Thomas, H. 1986. Strategic groups: Theory, research and taxonomy. Strategic Management Journal, 7: 141-160.

- McKelvey, W. 1982. Organizational systematics: Taxonomy, evolution, and classification. Los Apgeles: University of California Press.

- Miles, R., & Cameron, K. 1982. Coffin nails and corporate strategy. Englewood Cliffs, NJ: PrenticeHall. :

- Mintzberg, H. 1978. Patterns in strategy formation. Management Science, 24: 934-948.

- Mintzberg, H., & McHugh, A. 1985. Strategy formation in adhocracy. Administrative Science Quarterly, 30: 160-197.

- Nelson, R., & Winter, S. 1982. An evolutional theory of economic change. Cambridge: Harvard University Press.

- O’Brien, J 1983. Computers and information processing in business. Homewood, IL: Irwin.

- Pearce, .A., Freeman, E.B., & Robinson, R.B. 1987. The tenuous link between formal strategic planning and financial performance. Academy of Management Review, 12: 658-675.

- Penrose, E.T. 1958. The theory of the growth of the firm. New York: Wiley.

- Perrow, C. 1986. Complex organizations: A critical essay (3rd ed.). New York: Random House.

- Polanyi, M. 1962. Personal knowledge: towards a post critical philosophy. London: Routledge.

- Porras, J, & Berg, PO. 1978. The impact of organizational development. Academy of Management Review, 3: 249-266.

- Porter, M. 1980. Competitive strategy. New York: Free Press.

- Porter, M. 1981. The contributions of industrial organization to strategic management. Academy of Management Review, 6: 609-620.

- Porter, M. 1985. Competitive advantage. New York: Free Press.

- Porter, M. 1990. Why are firms successful. Paper presented at the Fundamental Issues in Strategy Conference, Napa, CA.

- Rasmussen, J 1986. Information processing and human machine interaction. New York: North Holland.

- Reed, R., & DeFillippi, R. 1990. Causal ambiguity, barriers to imitation, and sustainable competitive advantage. Academy of Management Review, 15: 88-102.

- Rhyne, L.C. 1986. The relationship of strategic planning to financial performance. Strategic Management Journal, 7: 423-436.

- Ricardo, D, 1966. Economic essays. New York: A.M. Kelly.

- Rumelt, R. 1984. Towards a strategic theory of the firm. In R. Lamb (Ed.), Competitive Strategic Management: 556-570. Englewood Ctiffs, NJ: Prentice-Hall.

- Rumelt, R., & Wensley, R. 1981. In search of the market share effect. In K. Chung (Ed.}, Academy of Management Proceedings 1981: 2-6.

- Scherer, FM. 1980. Industrial market structure and economic performance (2nd ed.). Boston: Houghton-Mifflin.

- Schumpeter, J. 1934. The theory of economic development. Cambridge: Harvard University Press.

- Schumpeter, J. 1950. Capitalism, socialism, and democracy (3rd ed.). New York: Harper.

- Stinchcombe, A.L. 1965. Social structure and organizations. In 1G. March (Ed.), Handbook of Organizations: 142-193. Chicago: Rand-McNally.

- Thompson, A.A., & Strickland, A.J. 1983. Strategy formulation and implementation. Dallas: Business Publications.

- Tomer, JE 1987. Organizational capital: The path to higher productivity and well-being. New York: Praeger.

- Wernerfelt, B. 1984. A resource based view of the firm. Strategic Management Journal, 5: 171-180.

- Wernerfelt, B. 1989. From critical resources to corporate strategy. Journal of General Management, 14: 4-12.

- Wilkins, A. 1989. Developing corporate character. San Francisco: Jossey-Bass.

- Williamson, O, 1975. Markets and hierarchies. New York: Free Press.

- Winter, S. 1988. Knowledge and competence as strategic assets. In D. Teece (Ed.) The Competitive Challenge. Cambridge: Ballinger. 159-184.

- Zucker, L. 1977. The role of institutionalization in cultural persistence. American Sociological Review, 421: 726-743.